Making lives better through customer engagement

Building long term relationships with our customers is core to our growth strategy and organisational values. Customer engagement helps us to deepen our understanding of our customers and reinforce our relationship with them.

activities that enable and create value for our members

outputs

beneficial outcomes for all

The Fund’s mandate over the years has been to extend social security to as many members as possible. Despite the restrictions under the NSSF Act, the Fund has been able to continue on its innovation journey, encouraging everyone to make savings part of their lives.

Leveraging on technology, we have continued to adapt to working in the new normal without compromising the quality of services we offer to our members. This has empowered us to improve service delivery and engagements with our customers amidst the COVID -19 pandemic, thereby re-confirming our commitment to making lives better for our members.

Our innovations that created value

Connecting with customers affected by the Covid-19 pandemic

Listening attentively to our member’s needs and understanding their challenges during these unprecedented times has been critical during the financial year.

In our effort to make lives better, the Fund made a decision to extend support to our members who were critically ill and admitted to hospital due to Covid-19, enabling them to access their benefits so as to pay for medical treatment.

This Covid-19 related payment is partial with the maximum payable amount of UGX 50Million.

We also continued to drive customer education and advice about our benefits offering for our customers through our online channel platforms, hence reducing physical presence.

Having adapted to working in the new normal without compromising the quality of services we offer to our members, we successfully held our first Virtual Annual programmes including the Customer Connect Week, Annual Members Meeting, Financial Literacy sessions and our Self-Service Electronic channels have continued to enable our customers to access our services from wherever they are, limiting physical contact.

In our member’s own words:

"I am very appreciative of the assistance provided by NSSF to access my savings which enabled me to pay my bills and buy much needed medicine. I have decided to increase my voluntary savings since God has given me another chance to live"

by Nakamya AnnetEmpowering customers through financial wellness

Despite the challenges of the Covid-19 pandemic, we managed to deliver our Financial Literacy programme cohorts through digital platforms and partnerships. With only 11% out of the 17 million labour force in Uganda assured of regulated retirement savings, the Fund provides tools and content to empower our members and customers can build financial security and resilience especially during the Covid-19 pandemic.

We registered an uptake of 67,272 participants compared to 7,481 in financial year 2019/2020, while we reached 1,489,000 individuals compared to 25,000 respectively. We also registered 82 partner institutions that provided insights based on domain expertise to customers. Through the surveys conducted we achieved an 85% Financial Literacy satisfaction rating.

Enhancing our value through the Annual Members Meeting

The Fund’s mandate over the years has been to extend social security to as many members as possible. Despite the restrictions under the NSSF Act, the Fund has been able to continue on its innovation journey, encouraging everyone to make savings part of their lives.

Leveraging on technology, we have continued to adapt to working in the new normal without compromising the quality of services we offer to our members. This has empowered us to improve service delivery and engagements with our customers amidst the COVID -19 pandemic, thereby re-confirming our commitment to making lives better for our members.

Leveraging on digital technology channels

As a result of restrictions on public movements and gatherings, we continued to leverage on technology to enable and empower our customers to access our services from wherever they are.

Key milestone achievements are outlined below:

The "Sanyu" Chatbot: Transforming customer experience with self-service

With experiencing a high volume of frequent customer queries, we did not have a solution that offered customers the same efficient experience and convenience as with our various digital platforms. Additionally, we estimated that our customer service personnel were spending much of their time responding to routine support requests which could be automated, allowing them to focus on more complex tasks including providing psychological and financial wellness support to members in these unprecedented times.

As a result, we deployed ‘Sanyu’, an Artificial Intelligent-powered chatbot that simulates human conversation and addresses routine requests through powerful text-based chat and self-service capabilities. This was deployed on our customer-facing platforms and messaging clients via Twitter DM, Facebook Messenger and the Corporate Website. Sanyu is enabling our customers to register with NSSF, track their benefits processing, check their provisional balance statements and respond to their Frequently Asked Questions (FAQs). Where customer requests cannot be fulfilled, Sanyu is seamlessly routing the query to the best available agent.

Since its deployment, we have obtained 240,194 customer interact transactions via the chatbot. Customer requests are now resolved faster and up to 75% of routine agent interactions are handed off to chatbot. We have been able to increase customer convenience increasingly with personalised virtual concierge. As a result, contact center agents have been able to refocus their time on more complex requests that require direct intervention.

Accelerating Enhancement of our SMS and USSD Short Codes

We enhanced the SMS 6773 and USSD *254# short codes with additional self-serve portals, enabling our customers unable to access the NSSF Go App to opt for these. The services we deployed include:

As a result, we registered 1,730,520 customer interact transactions, which contributed to increased uptake of the e-channels.

In our member’s own words:

They are also innovative. A few years ago, you had to visit the branch to get any issue addressed, so the queues were very long. Nowadays, I don’t have to visit the branch. They even send you an alert every month on your contribution status without having to ask.

by FGD, Mbarara

Leveraging on feature phones to make lives better

We contributed to increasing Self Service Electronic activity, when we empowered 2,500 customers without smartphones to each receive a feature phone as part of our Corporate Social Responsibility (CSR). This enabled us to recruit 2,500 customers to our online channels. The Feature Phones are enabling our customers to access our services from wherever they are.

Key performance of our self-service electronic channels

Our customers are now enjoying more convenience, having leveraged on technology to enable them to access our services online. As a result, we obtained the following performance on our digital self-service electronic channels:

Ongoing actions to improve our Members’ experience

To achieve operational efficiency, we completed the deployment of the Workforce Optimisation tool within our e-channels contact centre. As a result, we continued to register an average of 86% Service Level against a target of 80%, matching our drive for improved customer service experience and engagement.

We also conducted an Empathy drive to reiterate the customer centricity message among staff. Through a survey we conducted, the staff Empathy IQ came out at a score of 66% against a target of 50%.

To improve the quality of customer experience, we worked with different internal departments/sections to timely identify and close service gaps from the Customer Satisfaction Index (CSI), Mystery Shopper, Net Promoter Score (NPS) reports and internal service quality reviews. We also conducted root cause analysis to identify customer pain points and implement solutions to avoid recurrence of issues.

Understanding that our customer facing staff are the beating heart of our business, especially in the new normal, we continue to empower them with relevant standards of service and information content through calibration. We also implemented our comprehensive Customer Experience Training Plan by placing key staff on annual leadership coaching sessions, customer experiential trainings and digital transformation certification through online solutions. Additionally, weekly and daily cohort hurdles were held with frontline staff which provided a platform to share experiences and address challenges in hindering service delivery and implement appropriate solutions, noting that over 60% of our customer experience team are working from home.

Driving excellence in customer experience

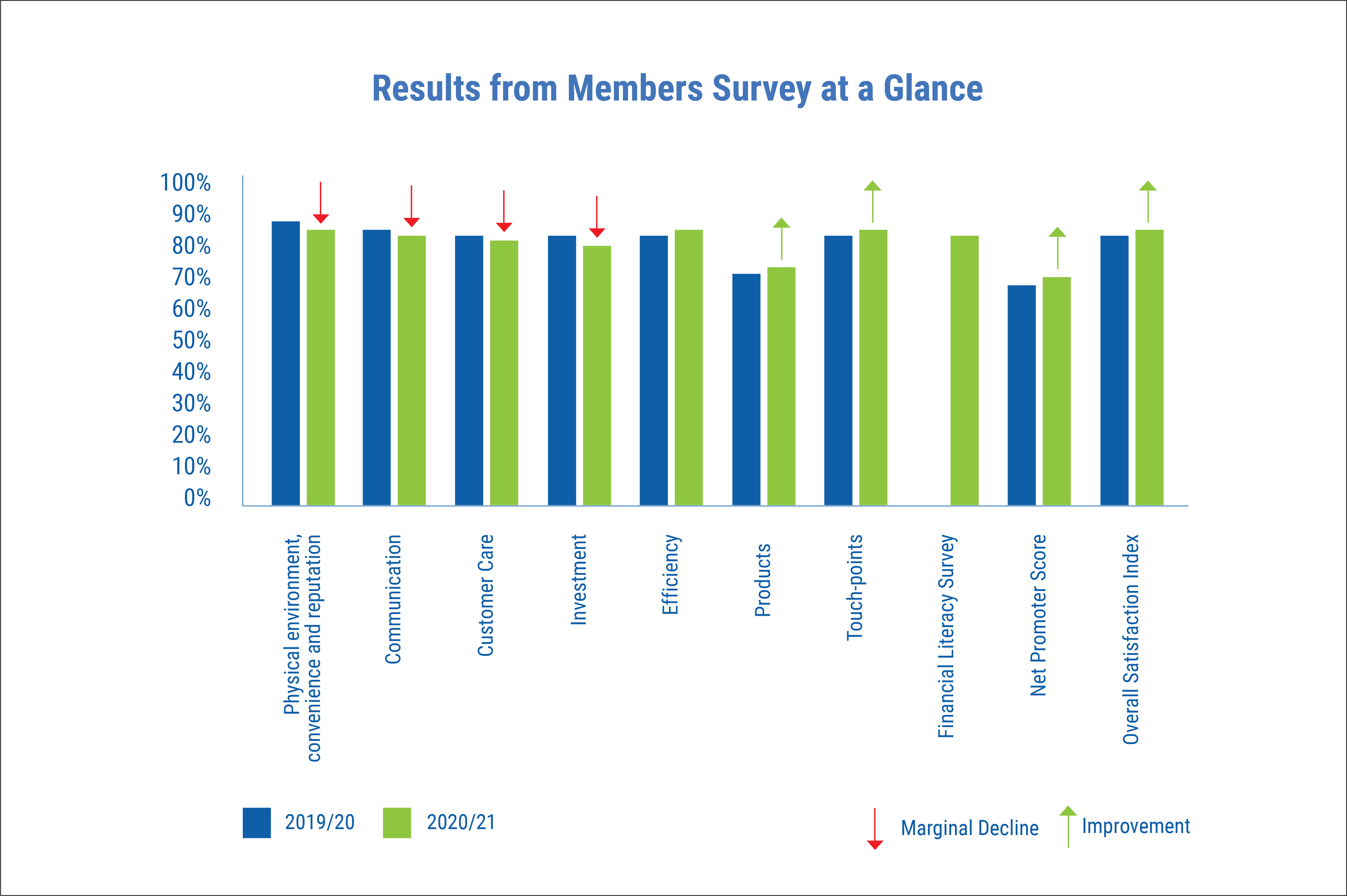

To deliver a greater customer experience, we continuously measure the quality of our services through surveys conducted with our members. Our purpose is to identify opportunities to improve the service experience.

Key Insights we use

The key insights we use to continuously improve our services, and remain customer centric are:

Key Objectives

The key objectives and metrics

we track are:

We have also used the insights to improve operational efficiency and embrace agility at scale.

We therefore obtained:

The graph on the left illustrates the results of surveys conducted.

We acknowledge the need for greater improvement to further improve our customer experience. We are always open to feedback and acknowledge the need for continuous improvements. Customer pain points below were identified in the customer satisfaction and mystery shopper index scores below.

-4%

%Satisfaction points missed from target for after sales follow up.-13%

% Satisfaction points missed from target in order to make Chatbot, email, NSSF Go Customers happy.-6%

% Satisfaction points missed from target in order to make Customers happy with jargon free language.We aim to resolve these with the implementation of the following initiatives which are underway to ensure improvement across the touchpoints in the coming Financial Year and beyond: