Retirement Journey

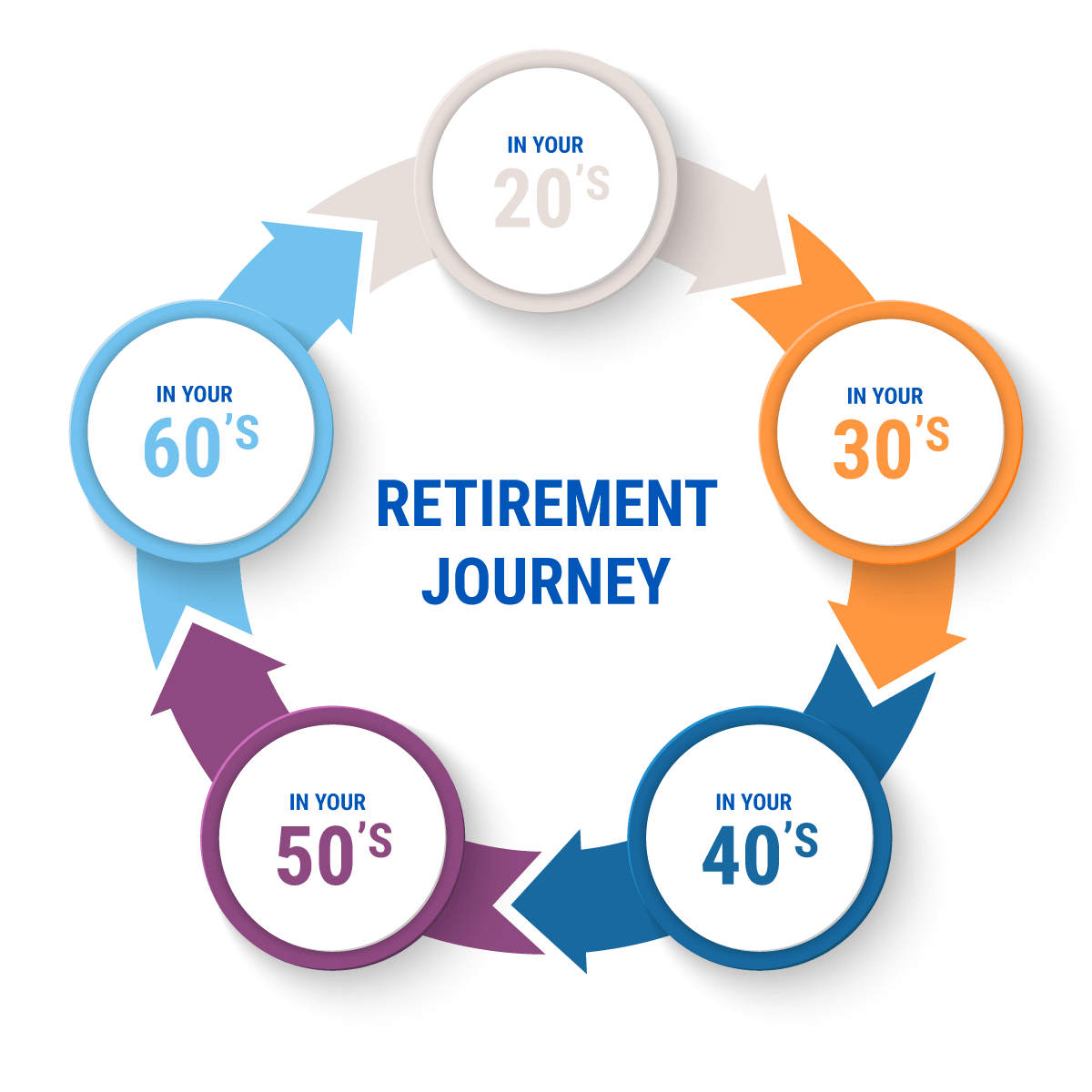

Preparing for retirement is a journey and must be carefully planned. It is surprising how many people don’t know how to plan for retirement and start the process too late in their career. Often, the impression is that retirement is a destination reached at a certain time of one’s life. However, retirement is a journey that starts early in one’s career when one begins to accumulate wealth that will eventually be used when the retirement milestone is reached. When a person retires, they start spending the savings accrued during their career. Many people start the ‘saving’ journey too late - and cannot save enough before their retirement milestone is reached. The road of life continues to unfold after retirement, and the size of your accrued wealth determines whether the road ahead will be smooth or rocky.

Thinking ahead:

The accepted wisdom is that you need to start saving for your pension as soon as you are employed, but if you think about it at a later stage, it is still worthwhile to start ASAP. Retirement may seem like a distant phase in your life if you are under 30, or even a missed opportunity to save for if you are over 40 but investing in your future is a life decision that is never too late to make. Starting your pension fund is as much a mental battle as it is a financial one.

Starting the Journey:

In your 30s, you are probably settling into your career, and your retirement is most likely the furthest thing on your mind. Your compensation may not permit you to spare much for retirement funding; however, you have time on your side. At this stage, you should start contributing to long-term investments, and should not procrastinate. The Fund recommends putting at least 10% of your income toward retirement in your 30s. Since your time horizon is still long, you can venture into more risky investments (aggressive funds tend to grow more quickly). However, you should be careful when choosing risky investments and only choose those that you are comfortable with.

It is a great time to use any salary increments; divert any pay raises into savings, rather than spending them.

The Journey continues:

Retirement starts to become a reality in your 40s. Between school fees, rent, medical bills and day-to-day survival, there are numerous things competing for a piece of the salary pie. It is easy to neglect saving for retirement, however you are only 15 to 20 years away from retirement, so you need to continue saving and seriously consider boosting your savings as much as possible. At this age, there is still some time for compound interest to do its work.

Milestone in sight:

You are on the home stretch to your retirement; however, you are not there yet. Take your calculator or spreadsheet and crunch some numbers. The Fund recommends stronger financial literacy which will enable you to take your rough plan and turn it into a precise detailed plan. Points that need to be considered include; where do you want to live during retirement, how much will your living costs be, what will your source of retirement funding be and how long will it last? At this stage, you should start moving your investment funds into more conservative investments, protecting the capital base by reducing the risk.

Having practical expectations about your post-retirement spending habits will help you define the desired size of a retirement portfolio. Most individuals believe that after retirement, their spending will amount to only 70% to 80% of what they spent previously which has proven to be unrealistic, especially if the mortgage has not been paid off or if unexpected medical expenses occur. It is fundamentally critical to constantly review your plans and make sure you remain on track.

Retirement milestone and beyond:

You are now claiming from your savings and investments. Your priority is to make sure you have financial security for as long as possible. Unexpected events may require more cashflow; you may need to consider liquidating some long-term investments. Ordinarily during this period more consolidation is required by increasing the level of guaranteed income and reducing risks of losing cashflow. You need to make sure your retirement finances remain in good shape. The Fund recommends that you plan your transition into retirement two or three years ahead of schedule.

Retirement is not the end of the road. It is the beginning of the open highway.

Benefits of saving with NSSF

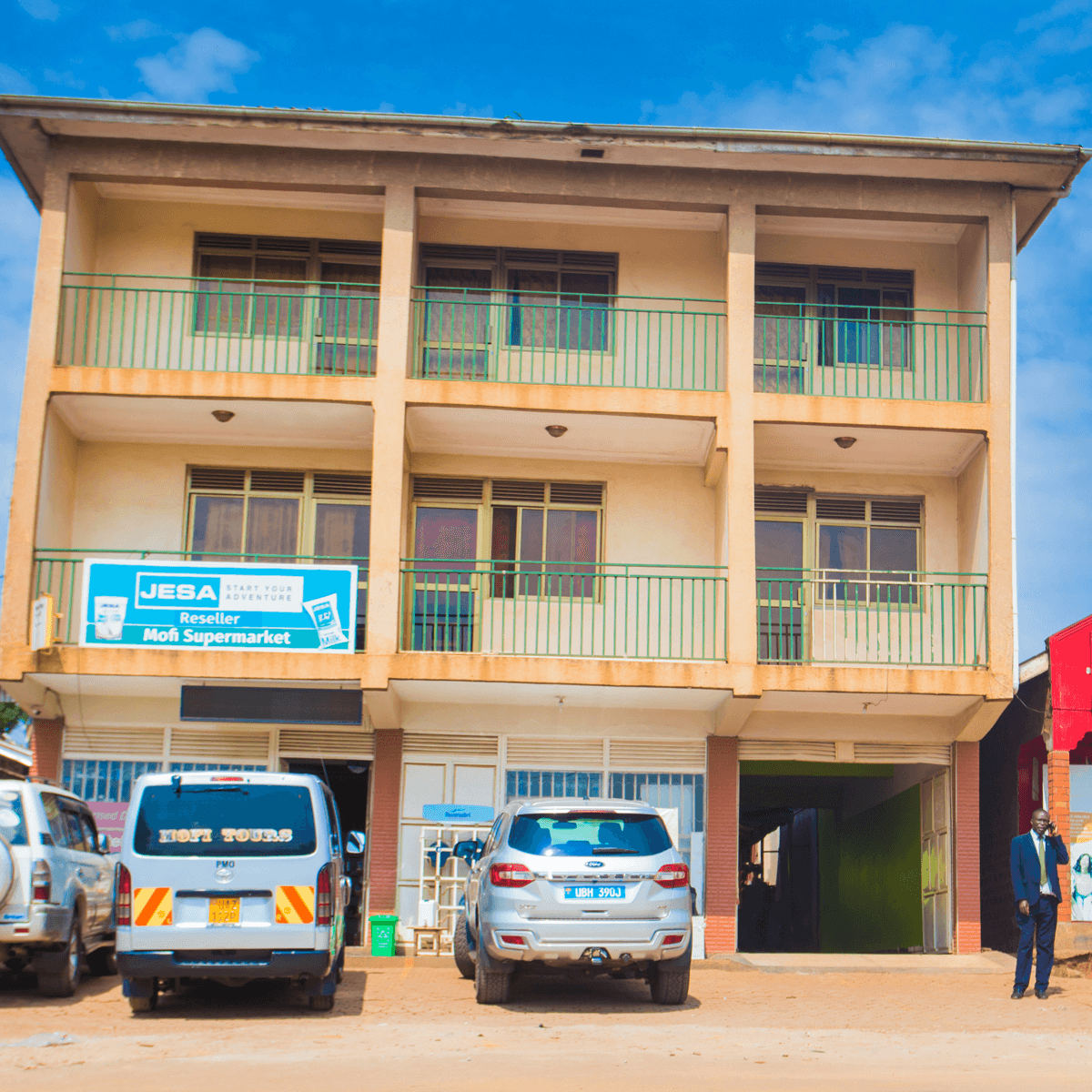

In demonstrating the benefits of saving with NSSF, we would like to introduce you to one of our retired members; Owako Martin.This is Martin’s career journey and incredible story of how saving for his retirement has assisted him and his family to prosper for a better future.

Martin is the proprietor and CEO of MOFI Uganda Limited. MOFI Uganda Limited comprises various business ventures. Recently, Martin was able to complete his Ph.D. courtesy of his NSSF savings. Accomplishing this doctorate is going to enable him to focus on innovating and growing the consultancy arm of his business.

1. What is your background and where did you start your career journey?

My background is in sales and marketing. I worked in various entities in this field. I started my career journey as a relief sales representative and rose through ranks in the Diageo Sales and Marketing Framework from direct sales, distribution management, trade marketing and finally into sales capability as a trainer and field coach at Uganda Breweries Limited.

2. At what point did you start employment?

I started formal employment over 25 years ago. For the first 14 years, I worked with East African Breweries Limited then I moved to Smile Communications for around 2.5 years. There was an urgent need for me to come back and settle in this business. I left formal employment when I was 48, to focus on MOFI which required a lot of planning.

3. When did your employer start deducting NSSF Contributions from your salary?

Uganda Breweries Limited started deducting in June 1996, and for 14 years my contributions were faithfully deducted and remitted to the Fund.

4. At the beginning of this journey, what were your sentiments on Social Security?

I regarded social security as money that would be given back at a certain point to help me in my retirement and assist me to accomplish a few of my unfinished business ventures. My vision for retirement was to stabilise my financial situation in the future.

5. What were some of the sacrifices you had to make in your journey to secure your future?

The major sacrifice I made was to do away with a life of luxury. I used to tell my former colleagues and supervisors at work that the only way you can move forward is if your savings are substantial both with NSSF and as an individual. Even today in my house, I have basic needs and I drive a commercial car. However, if you invite me to go for exercises like jogging or an event (one for a worthy cause) I will participate.

6. What has been the end benefit of saving with NSSF?

My savings have done a lot in my life. I was able to enroll for my Ph.D in 2017 for which I am yet to graduate. I have multiple income streams from which I can sustain my life and continue educating my children. In the next 2 years, I am planning to develop 50 acres of land that I secured in Pallisa to grow my entrepreneurial farming i.e., from poultry to fruit, such as mangoes. This achievement is also going to enable me to grow the consultancy arm of MOFI Uganda Ltd.

I discovered a niche market for students who are studying for their master’s and Ph.Ds. of any field who need guidance and support as they finalise their thesis’s.

What I have gained from studying is the effects of strategic innovation on an organisation’s performance. Innovation is about creating new ideas all the time and implementing them, how you do things differently to survive and then succeed. So, each time I see people stuck I think of a better solution for them to thrive.

7. How and when were you able to start utilising your savings to secure an even more prosperous future?

Once I received the Shs205m from the Fund, I did not want to put all my eggs in one basket. Having a comfortable retirement life was key so I set aside Shs60m for a residential house in Pallisa where we fenced off one and a half acres for chicken and turkeys which took around Shs15m.

I had seen so many people lose their money, so I consolidated all the income streams into one MOFI Uganda Ltd. I went ahead and used around Shs60m to purchase a new van for our transport and tours’ business. We boosted the supermarket with Shs30m, used another Shs10m to renovate the guest house because customers need a fresh environment all the time. These have been affected by Covid-19 but we are continuously innovating solutions to keep them open.

8. If you knew then what you know now, being wiser about financial security, what advice would you

give to young adults as they start their careers?

I think that I started saving late. If I had started earlier, I would be in better position. What I mean is that I started early as an individual but late for the people who depended on me. They were solely reliant on my support. I realised that 10 years ago and had to train them so that they would be able to generate their own income. I can now rest and can afford to travel away from Uganda because I am comfortable they know what to do. I can run 10 businesses because all I must do is empower them by upskilling them to move forward.

In terms of succession planning, all my children have been integrated into MOFI Uganda Ltd. All my business ventures have been mapped out to serve their different careers. The foundation has been laid and now the goal is to multiply and grow the business well beyond their generation.

9. What message would you have for those who are saving with NSSF?

Members who are wanting to redeem their benefits early should think twice. This money is supposed to help you at the point when you leave your job with an employer and begin the next phase of your journey beyond retirement, as your life is far from over. Your life has just begun and your savings can help you achieve your dreams for a brighter future.

Post Retirement Survey

In a bid to understand and aid our members plan their retirement better, the Fund conducts post retirement surveys to enable us to review and assess the quality of life and expenditure priorities of social security beneficiaries

Key take outs from the results:

How the Fund is planning to make our members’ lives better:

Through the Financial Literacy and Hi- innovator programs, the Fund is preparing its members to plan their retirement journey. These programmes are premised on up-skilling members to boost their income through various entrepreneurial engagements with subject matter experts. This has been made accessible to both existing members and the general public.

Through the ‘Catch Them Young’ initiative, the Fund along with various partners committed to assume a leadership role to support government efforts to improve learning conditions in public schools. The objective is to empower youth and children socially and economically to be able to take advantage of their full citizenship by creating economic opportunities through functional education, training, guidance, research, development, and service provision.

Through the Voluntary Contributions Scheme, the Fund continues to encourage retirees that are actively working to continue saving which offers Members a more secure return through interest earned.

The Fund through the proposed NSSF Amendment Bill seeks to improve and increase products and services for its members that cater for members’ pertinent needs.